|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

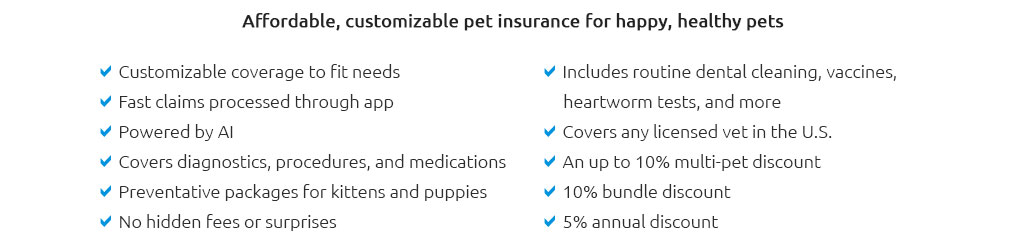

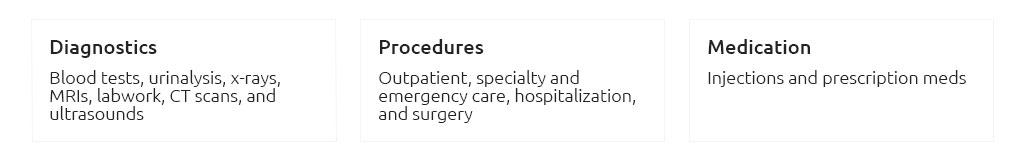

Understanding Dog Health Insurance: A Comprehensive ComparisonAs pet ownership continues to rise, the importance of safeguarding our furry companions has never been more crucial. Dog health insurance, once a niche product, is rapidly becoming a staple among responsible pet owners. However, with a plethora of options available, choosing the right plan can be daunting. This article delves into the intricacies of dog health insurance, providing a thorough comparison to guide you in making an informed decision. At the heart of dog health insurance is the concept of mitigating unforeseen veterinary expenses. Much like human health insurance, these plans cover a range of medical issues, from routine check-ups to emergency surgeries. Yet, not all plans are created equal. Factors such as coverage limits, premiums, deductibles, and exclusions vary significantly among providers, demanding a meticulous evaluation. To illustrate, consider two popular insurance companies: Healthy Paws and Embrace Pet Insurance. Healthy Paws is renowned for its straightforward approach, offering a single plan with unlimited lifetime benefits. Their policy is particularly beneficial for breeds predisposed to chronic conditions, as it covers hereditary and congenital issues. In contrast, Embrace offers customizable plans, allowing owners to tailor coverage according to their pet's specific needs. This flexibility can be invaluable for those with senior dogs or unique medical histories. While both companies boast high customer satisfaction, the choice between them often boils down to individual preferences. Some owners prioritize comprehensive coverage, regardless of cost, while others seek affordable plans with essential benefits. It's worth noting that annual premiums can range from $300 to over $1,000, depending on the dog's age, breed, and location. Moreover, understanding the nuances of policy exclusions is imperative. Many plans exclude pre-existing conditions, a critical consideration for dogs with prior health issues. Additionally, some providers impose waiting periods for specific treatments, potentially delaying care when it's most needed. Ultimately, the decision hinges on balancing cost with peace of mind. Investing time in comparing plans, reading reviews, and even consulting with veterinarians can illuminate the most suitable choice for your canine companion.

As we navigate this landscape, several key points emerge. Firstly, research is paramount. Utilize online resources, seek recommendations from trusted sources, and don't hesitate to ask questions directly to insurance companies. Secondly, consider your dog's unique needs. A young, healthy dog may require a different plan compared to a senior pet with existing conditions. Lastly, anticipate future health scenarios. Dogs, like humans, are susceptible to unexpected illnesses, and insurance can be a crucial safeguard. Frequently Asked QuestionsWhat does dog health insurance typically cover? Most plans cover accidents, illnesses, surgeries, and medications, while some extend to routine care and alternative therapies. Are pre-existing conditions covered by dog health insurance? Generally, pre-existing conditions are excluded, although some insurers may cover them after a waiting period if the condition is considered curable. How do deductibles and co-pays work? Deductibles are the amount you pay before the insurance kicks in, while co-pays are the percentage of the bill you pay after meeting the deductible. How can I reduce the cost of dog health insurance? Opt for a higher deductible, tailor the coverage to essential needs, and inquire about discounts for multi-pet households or annual payments. Is dog health insurance worth it for young, healthy dogs? Yes, insuring young dogs can be beneficial as it protects against accidents and illnesses, often at a lower premium compared to insuring older pets. https://www.usnews.com/insurance/pet-insurance

Pumpkin is the best pet insurance overall, according to our research. Lemonade offers the lowest average rates in our study making it a good option for pet ... https://www.consumerreports.org/money/pet-insurance/buying-guide/

Your pet's breed may make them susceptible to known health complications that impact the price of their insurance coverage or even their ability ... https://www.petmd.com/general-health/pet-insurance-comparison-101

The monthly premium should be considered in relation to the deductible and reimbursement percentage. Together, these three factors will ...

|